The 2 Types of Scams You Need To Know

A rose by any other name would smell just as sweet, and a scam by any other title is still a scam. Scams come in all shapes and sizes, with a dizzying array of names to accompany them. Job scams, social media scams, high-yield investment scams, binary options fraud, impersonation scams, advance-fee scams – though their names are different, many types of scams often employ the same tactics to convince victims to part with their money.

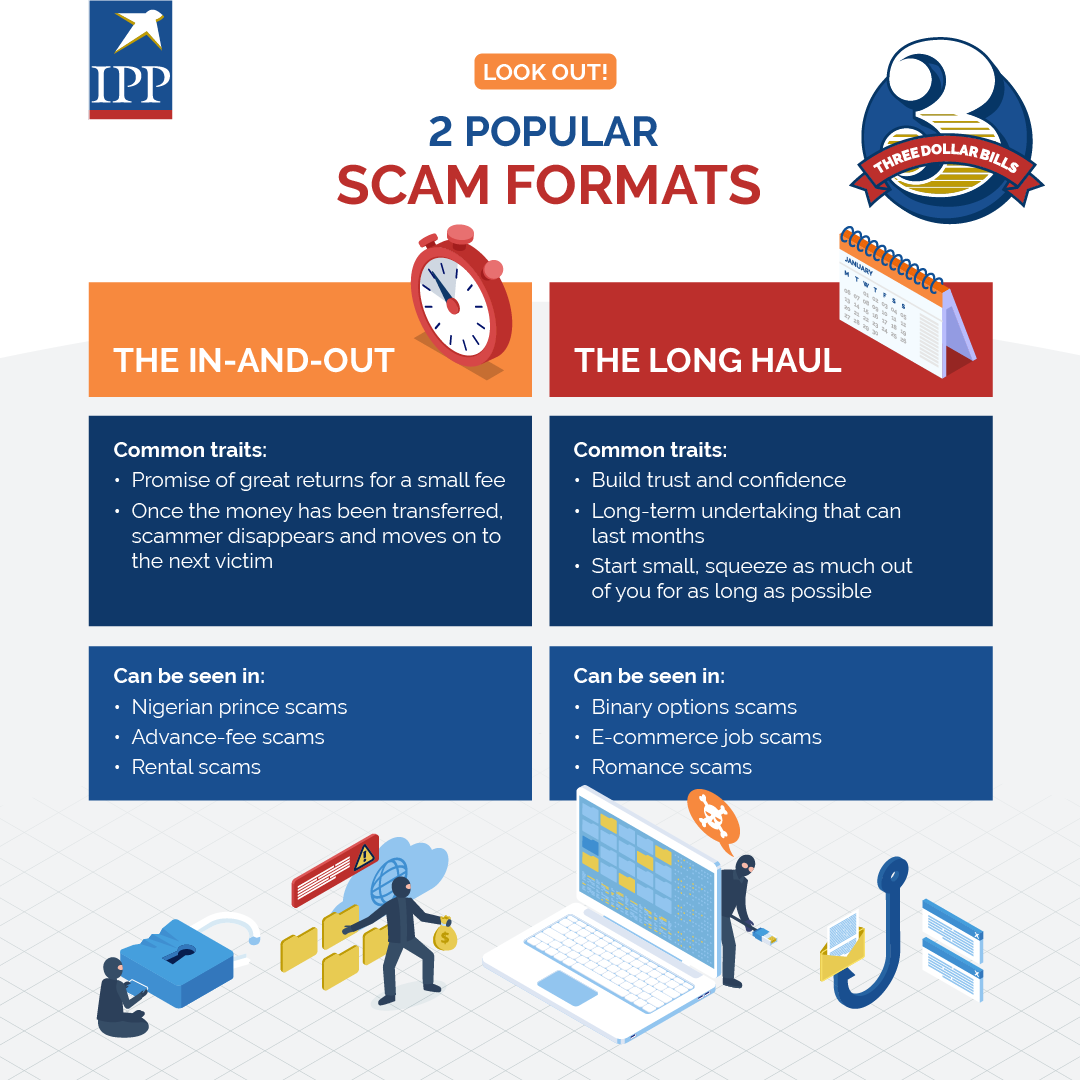

When there is money involved, there are two types of scam formats, broadly speaking: scammers who aim for a quick cash grab before leaving to find the next victim, and scammers who set up for “the long con” with the aim of extracting as much as possible from each victim before becoming uncontactable.

A Quick Grab

Affectionately known as the Nigerian prince scam, the first type of scam format sees the scammer employ whatever tricks are necessary to get you to part with your money. They may claim that you have an inheritance from a long-lost relative that will be released to you once you pay an admin fee. In the early iterations of this scam, victims would be led to believe that this long-lost relative was actually a Nigerian prince, hence the name. Other types of scams with similar setups but different premises include rental scams and advance-fee scams. The scammer might tell you that you will be able to secure a home rental if you put down a deposit with them, or that they will be able to help you make millions in exchange for a small upfront fee. Whatever story they spin for you, as soon as you transfer the funds to them they become uncontactable and it can be difficult to get your money back, especially if the funds have been moved to overseas accounts.

The Long Con

In the second scam format, the scammers’ goal is to have victims deposit ever-increasing amounts of cash with them over time, before finally becoming unreachable and vanishing once the jig is up. The scammers start off small, slowly building trust and confidence in order to convince victims to keep handing over their money. This is commonly seen with romance and investment-type scams, though with the rise in e-commerce job scams that adopt this approach have also surfaced.

A job scam might go something like this: first, scammers lure job applicants in with the promise of being able to earn a few hundred dollars a day; all they have to do is purchase certain products from e-retailers, after which the money along with a commission will be refunded to them. The scammers start small and slowly increase the amount requested from the victim each time, building trust and rapport until they suddenly become uncontactable and the money disappears.

The same tactic of starting small and refunding initial amounts can be found in other scams, from binary options scams on social media to cryptocurrency scams. With binary options scams, victims are first encouraged to deposit a small amount and, upon seeing success and profits, emboldened to invest more and more money, until they find themselves making a loss or being unable to withdraw their earnings. This scam tactic is not just limited to binary options, and has been replicated with cryptocurrency investments, which are notoriously difficult to recover once the transactions have been made.

Conclusion

While technology evolves and scams along with them, the fundamentals underpinning these scams will continue to stay the same. No two scams will look exactly alike, but learning how to spot the patterns will help you guard against them no matter what form they take.

“This advertisement has not been reviewed by the Monetary Authority of Singapore”

Disclaimer: Investments have investment risk. Past performance is not necessarily indicative of the future performance of an investment. Please seek advice from a Financial Adviser Representative before making any investment decisions.

IPP Financial Advisers Pte Ltd

78 Shenton Way #30-01 Singapore 079120 | Tel: +65 6511 8888 | enquiry@ippfa.com |

IPP Financial Advisers Pte Ltd

78 Shenton Way #30-01 Singapore 079120

Tel: +65 6511 8888 | enquiry@ippfa.com